Self and dependent relatives. Updated Guide On Donations And Gifts Tax Deductions.

Now every individual in Malaysia who is liable is required to declare their income to the Inland Revenue Board of Malaysia LHDN annually.

. Tax rebates are not deducted from your chargeable income like a tax relief is but from your final tax amount at the end. Taxability and Deductibility of Foreign Currency Exchange Gains and Losses. Removed YA2017 tax comparison.

The exchange rates may have varied in the period between 1532019 and 1562019 but if the exchange rate on 1562019 was RM420 USD1 again the RM equivalent for UDS10000 was RM42000. Tax deduction not claimed in respect of expenditure incurred that is subject to withholding tax which is not due to be paid on the day the return is furnished. Introduced PCB Schedule Mode where PCB amount will match LHDN PCB Schedule.

EPF tax relief limit revised to RM4000 per year. Income tax deductions for contributions made to any social enterprise subject to a maximum of 10 of aggregate income of a company or 7 of aggregate income for a person other than a company Reduction of corporate tax rate for small medium enterprises SMEs on chargeable income of up to RM 500000 to 17 from 18 effective from YA 2019. Updated PCB calculator for YA2019.

These are the types of personal reliefs you can claim for the Year of Assessment 2021. Within 1 year after the end of the year the payment of withholding tax is made. Under the Income Tax Deductions For The Employment of Disabled Persons Amendment Rules 2019 PUA 2042019 an addit ional deduction of RM6000 is allowed in computing the adjusted income of the EXSBs business.

Tax deduction malaysia 2019 Income from RM5000001. Up to RM7000 life insurance. 62 Double Deduction for training a disabled person who is not an employee.

Insurance other policies. 20182019 Malaysian Tax Booklet Income Tax. Whats The Difference In Tax.

EIS is not included in tax relief. This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from RM1640 to RM585. Therefore there is neither an exchange gain nor loss for ABC Sdn Bhd.

19 rows Additional deduction of MYR 1000 for YA 2020 to 2023 increased maximum to MYR 3000. Life insurance and EPF including not through salary deduction. 331 of the ITA.

8 EPF contribution removed. Do take note that this is not a tax relief but a tax deduction. Since this donation is limited to 10 of his aggregate income he can claim RM6000 10 x RM60000 in tax deductions.

Income Tax Malaysia 2017 vs 2018 For Individuals. More on Malaysia income tax 2019. Secretarial fee tax deduction malaysia 2019.

Employment Insurance Scheme EIS deduction added. For pensionable public servants. Thus his chargeable income after taking the tax deduction for his donation into account is RM60000 RM6000 RM54000 thus lowering the amount of tax he has to pay.

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

What Is Form Ea Part 2 Defining The Perquisites

Chapter 5 Corporate Tax Stds 2

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Solution Tax667 Jun 2016 Answer 1 I Computation Of Chargeable Income Of The Deceased And The Studocu

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Does Your State Offer A 529 Plan Contribution Tax Deduction 529 Plan How To Plan Tax Deductions

Latest News Chartered Accountant Latest News Accounting

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Tax In Malaysia Malaysia Tax Guide Hsbc Expat

/thinkstockphotos-144229773-5bfc2b3f46e0fb0083c06edd.jpg)

What Are Some Ways To Minimize Tax Liability

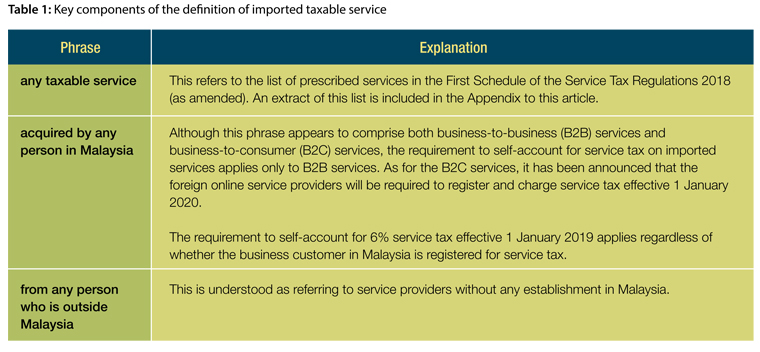

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today Malaysian Institute Of Accountants Mia

10 Things To Know For Filing Income Tax In 2019 Mypf My